ACCOUNTING TOOL – ZAZENSYNC

E-commerce Accounting Made Effortless

We automatically reconcile sales, fees, VAT, and payouts from Shopify, Amazon, PayPal, Stripe, and more — giving you books you can trust without the manual work.

Save hours on your monthly bookkeeping

The Problem. Our Solution.

Connect to all your platforms

The Problem

You’re selling across multiple platforms, from Shopify to Amazon to eBay, and somehow the payouts never seem to match the sales numbers. Add in shifting VAT and tax rules, and suddenly your time is spent reconciling spreadsheets instead of scaling your store.

The Solution

Our tool eliminates the chaos by connecting your e-commerce platforms directly to your accounting software (Xero or QuickBooks). Every order, fee, tax, and cost is captured, cleaned, and reconciled automatically.

The Result

No more wrestling with manual uploads or chasing numbers that don’t add up. No more nasty surprises with hidden fees creeping into your accounting bill. No more VAT headaches every time the rules shift.

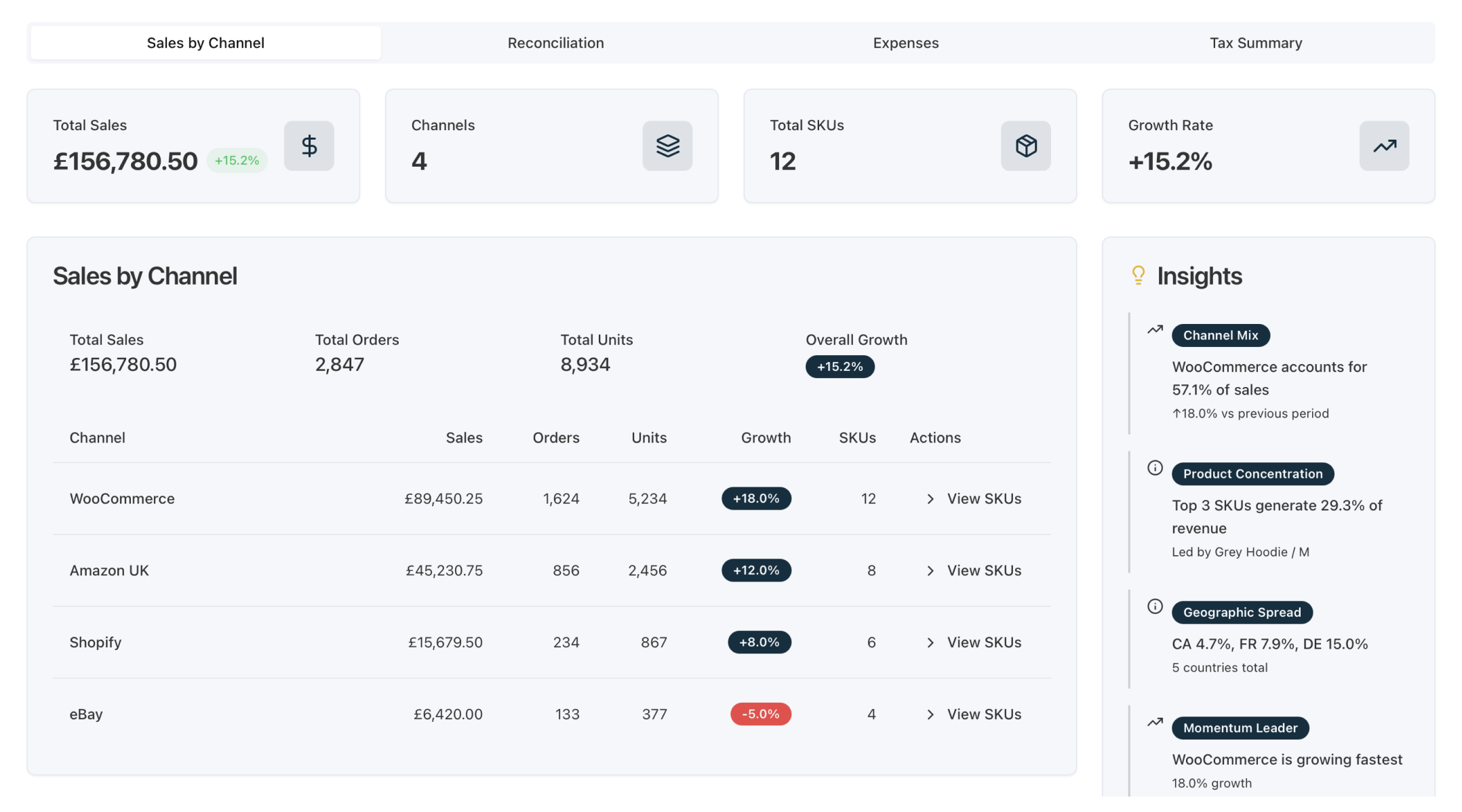

The Reporting

Analyse, track and share reports built on real-time data from across your workspace. With every sale, payout, and expense syncing automatically, you’ll always have a single source of truth at your fingertips.

DOWNLOAD NOW

Download bundle!

Gorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc vulputate libero et velit interdum, ac aliquet odio mattis. Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos.

Join thousands of professionals using this resource.

BENEFITS

The Benefits of using our tool

Sync Made Simple

Our system doesn’t just sync data — it intelligently aggregates and transforms transactions from every sales channel and payment processor into structured sales invoices and journals.

Time Saving

Manual uploads, reconciling fees, and checking tax codes take hours every week. We automate all of it.

It’s Scalable

Whether you’re a solo seller doing a few orders a week or a 7-figure brand with thousands of monthly transactions, our system grows with you.

TRUST

Built for E-commerce. Trusted by Accountants.

By Accountants

Our platform was designed by accountants who truly understand the moving parts of e-commerce.

We know the challenges of reconciling multi-channel sales, aligning payouts with orders, and staying ahead of shifting VAT rules across different regions.

Every feature is built with the realities of online selling in mind — giving you accurate, compliant accounts without the usual stress and second-guessing.

Efficient

Trusted by everyone from ambitious small shops to fast-growing 7-figure brands, our bookkeeping solution has already saved business owners thousands of hours and reconciled millions in revenue automatically.

Whether you’re just starting out or scaling globally, sellers rely on us to bring order to the chaos and keep their books consistently accurate.

Secure

Your data is protected with enterprise-grade security and handled in full alignment with GDPR standards. Our processes are HMRC Making Tax Digital (MTD) compliant, so your filings are always accurate and on time.

Plus, as certified partners with leading platforms like Xero and QuickBooks, you can be confident that every integration is seamless, secure, and built to industry best practices.

TRUST

Your are in good hands

Fixed Monthly Pricing

Forget unpredictable hourly fees. With our transparent packages, you know exactly what you’ll pay every month — and exactly what you’ll get.

PRICING

Plans to fit your business

Our packages are tailored to your business stage and financial year revenue. Customise your package with add-ons to suit your needs as you grow.

Operate

For business owners who want to ensure they tick all basic compliance boxes as they grow

from

£ 71/m

£850 billed annually, per financial year + VAT

Financial software

- Create, send and chase invoices

- Capture bills and receipts easily

- Pay bills in one click

- Reimburse expenses

- Connect your banks

- Use multiple currencies

- Connect ecommerce marketplaces

Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

Expert service

- Initial consultation with a tax expert

- In-app chat

- Tax advice on payroll and dividends

- Business review with accountant annually

Tax and filings

- Annual filings

- Self-assessment

Payroll

- PAYE registration

- 1st Director Payroll

Company admin

- Unlimited corporate changes

Historical work

- Catch-up bookkeeping £85/m

- Urgency filing £200

- Historical annual filing and bookkeeping £680/y

Grow

For businesses nearing VAT registration, seeking up-to-date analytics and consultations

from

£137/m

£1,640 billed annually, per financial year + VAT

Financial software

- Create, send and chase invoices

- Capture bills and receipts easily

- Pay bills in one click

- Reimburse expenses

- Connect your banks

- Use multiple currencies

- Connect ecommerce marketplaces

Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

Expert service

- Initial consultation with a tax expert

- In-app chat

- Tax advice on payroll and dividends

- Business review with accountant annually

Tax and filings

- Annual filings

- Self-assessment

Payroll

- PAYE registration

- 1st Director Payroll

Company admin

- Unlimited corporate changes

Historical work

- Catch-up bookkeeping £85/m

- Urgency filing £200

- Historical annual filing and bookkeeping £680/y

Scale

For entrepreneurs earning £350k+ annually, managing multiple roles and seeking to simplify financial tasks

from

£ 224/m

£2,690 billed annually, per financial year + VAT

Financial software

- Create, send and chase invoices

- Capture bills and receipts easily

- Pay bills in one click

- Reimburse expenses

- Connect your banks

- Use multiple currencies

- Connect ecommerce marketplaces

Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

Expert service

- Initial consultation with a tax expert

- In-app chat

- Tax advice on payroll and dividends

- Business review with accountant annually

Tax and filings

- Annual filings

- Self-assessment

Payroll

- PAYE registration

- 1st Director Payroll

Company admin

- Unlimited corporate changes

Historical work

- Catch-up bookkeeping £85/m

- Urgency filing £200

- Historical annual filing and bookkeeping £680/y

TESTIMONIALS

What our clients think about Zazentax

FAQs

Can’t find the answer you’re looking for? Please chat to our friendly team.

We provide bookkeeping, VAT returns, payroll, tax filings, annual accounts, and advisory services — tailored to freelancers, SMEs, and ecommerce businesses.

Yes. Every client works with a named accountant who knows your business inside out. You’ll never deal with call centres — just direct, personal support.

We’re certified partners with Xero and QuickBooks. Our digital-first approach means you’ll always have real-time access to your financial data.

We offer fixed monthly packages with no hidden fees. Pricing depends on your business size and the level of support you need — but you’ll always know exactly what you’re paying for.

Absolutely. We handle VAT, corporation tax, self-assessments, and payroll tax. We also manage HMRC correspondence on your behalf to ensure you never miss a deadline.

No. While many of our clients are London-based, we also support businesses across the UK and ecommerce sellers worldwide through our cloud-based systems.

RESOURCES

Fresh insights from our blog

Automation anxiety was real but misplaced; technology enhances rather than eliminates the accountant-client relationship.

Trust and communication drive 63% of hiring decisions, though only 23% mention them initially. Based on 8,400+ genuine conversations from UK small business owners on Reddit, X/Twitter, and Facebook, January 2024 – October 2025.

Based on Zazen Tax research across forums (Reddit, Glassdoor, Fishbowl), review sites (Trustpilot, Google), and industry discussions, here's a comprehensive analysis of the top complaints about accounting services companies.