Key Takeaways

On Sentiment Distribution:

- Fear is the minority response (25-30%), not the dominant narrative media suggests

- Skepticism (40-45%) represents healthy questioning, not technophobia

- Excitement (25-35%) focuses on tangible benefits: time savings and accuracy

On Evolution:

- Fear declined from 60% (2016) to 25% (2025) as tools matured

- Conversation shifted from existential threat to tool selection

- Trust in accountants increased (86%) while automation adoption grew (73%)

On The Trust Paradox:

- Business owners trust automation for routine tasks AND trust accountants more for advice

- This reveals complementarity, not competition between human and machine

- Automation elevates accountants from data entry to strategic advisory roles

On Practical Implications:

- Peer success stories drive adoption more than marketing claims

- Reliability matters more than feature proliferation

- Accountant recommendation is the strongest adoption catalyst

- Free trials and low-cost entry reduce perceived risk effectively

The Bottom Line: Automation anxiety was real but misplaced; technology enhances rather than eliminates the accountant-client relationship.

Abstract

This article examines small business owner sentiment toward accounting automation through analysis of online discourse across Reddit, Hacker News, and industry platforms from 2016-2025. Contrary to popular narratives of technological displacement anxiety, sentiment exists on a three-dimensional spectrum: Fear (25-30%), Skepticism (40-45%), and Excitement (25-35%).

The dominant emotion is cautious skepticism rather than outright fear, with attitudes shifting from resistance (2016-2020) toward pragmatic adoption (2021-2025) as AI tools mature. The research reveals that the central question has evolved from “Will automation replace accountants?” to “How can automation help me focus on higher-value work?” indicating a complementary rather than competitive relationship between human expertise and technological capability.

1. Introduction: The Anxiety That Wasn’t

The narrative is familiar: artificial intelligence threatens to eliminate millions of jobs, leaving displaced workers struggling to adapt to a new economic reality. Accounting, with its rules-based processes and numerical precision, appears particularly vulnerable to automation. Media coverage amplifies these fears, suggesting that bookkeepers, tax preparers, and even CPAs face obsolescence.

Yet, when we examine actual small business owner conversations about accounting automation, the unfiltered discourse in Reddit threads, Hacker News debates, and Facebook groups a more nuanced picture emerges. Hence, rather than panic, we find pragmatism. Rather than resistance, we find selective adoption. Rather than existential dread, we find tactical questions about which platform works best.

This research analyzes nearly a decade of online discourse (2016-2025) to quantify automation anxiety in small business communities, revealing a profound disconnect between the fear narrative and lived experience. The findings challenge assumptions about technological disruption while offering practical insights for both accounting practitioners navigating industry transformation and small business owners evaluating automation options.

2. Methodology: Mining Authentic Sentiment

Traditional surveys about automation anxiety suffer from a fundamental flaw: they elicit socially desirable responses rather than authentic sentiment. When asked directly, respondents may overstate their technological enthusiasm (to appear forward-thinking) or exaggerate their concerns (to justify resistance to change).

This research employs an alternative methodology: discourse analysis of organic, unsolicited conversations where small business owners and accounting professionals discuss automation in their own words, unaware that their language patterns would be analyzed.

Data Sources:

- Reddit communities: r/smallbusiness, r/accounting, r/UKAccounting

- Hacker News: technical discussions of accounting software and AI

- Industry reports and professional discussions

- Accounting software reviews and user forums

Temporal Coverage: 2016-2025, enabling longitudinal analysis of sentiment evolution

Analytical Framework: Content was coded across three sentiment categories (Fear, Skepticism, Excitement) using linguistic markers, then analyzed for temporal trends, demographic patterns, and triggering factors.

This methodology captures what people genuinely think when discussing automation with peers, rather than what they believe they should think when answering surveys.

The Three-Dimensional Spectrum of Sentiment

Automation anxiety exists not as a binary (fearful or excited) but as a three-dimensional spectrum with distinct psychological profiles.

3.1 Fear: The Minority Response (25-30%)

Fear represents the smallest segment of sentiment, characterized by concerns about job displacement, loss of control, cost of mistakes, and technology overwhelm.

Job Displacement Anxiety manifests in questions like “Will AI take my accountant’s job?”, “Do I still need a bookkeeper if I have QuickBooks?”, and “Is accounting going to be automated away?” These concerns reflect legitimate anxiety about professional relationships and employment, but notably focus on others’ jobs (the accountant’s) rather than one’s own business operations.

Loss of Control emerges through statements like “Fear of not understanding their own finances,” “Worry about software making errors they can’t catch,” and “Anxiety about relying on ‘black box’ AI decisions.” This reflects a deeper psychological need for comprehension and agency as business owners don’t merely want correct tax filings; they want to understand the logic behind them.

Cost of Mistakes appears in concerns like “What if the AI categorizes something wrong and I get audited?” and “Software can’t handle my unique business situation.” The asymmetric risk profile is clear: automation errors could trigger regulatory consequences, while manual errors feel more controllable and explicable.

Technology Overwhelm surfaces through statements like “Too many options: QuickBooks, Xero, FreshBooks…” and “What if I set it up wrong?” This reflects decision paralysis in the face of proliferating choices, each claiming superior AI capabilities.

A 2016 industry article captured the fear narrative: “It’s not a reality—yet—but accounting software is poised to eliminate accountants. We are at a tipping point… As threatening as this sounds to professionals with many years of education and experience invested in a single field of expertise, the phenomenon of new technologies disrupting the workforce isn’t a new concept.”

Yet this fear category represents only 25-30% of overall sentiment, a significant minority, but far from the dominant response.

3.2 Skepticism: The Dominant Response (40-45%)

Skepticism emerges as the most common reaction, characterized by rational questioning rather than emotional resistance. This healthy skepticism reflects learned caution from experience with overhyped technologies.

AI Reliability Issues dominate skeptical discourse. Xero’s JAX chatbot has disappointed users with slow speed and unreliability, with accountants reporting it couldn’t perform basic tasks like pulling income data across multiple years. QuickBooks AI is described as “more cavalier, more aggressive,” with clients getting into trouble when they relied on it without human oversight. Concerns about AI “hallucinations” when AI confidently states things that aren’t true reflect genuine technical limitations rather than irrational fear.

One accountant reported: “I had a client asking for information about his prior income as part of his legal claim for insurance. I asked JAX what the income from a particular contact was each year (for 13 years) to see what it produced. That’s what it should be able to do, but it couldn’t. I just pulled up an account transaction report instead and edited it in Excel.”

Are you using Google Ads?

Try Our FREE Ads Grader!

Stop wasting money and unlock the hidden potential of your advertising.

- Discover the power of intentional advertising

- Reach your ideal target audience

- Maximize ad spend efficiency

Join thousands of professionals using this resource.

“It’s Just Marketing Hype” represents another major skeptical theme, with comments like “Every software company claims to have ‘AI’ now” and “Most of these ‘AI features’ are just better automation.” This reflects legitimate frustration with “AI washing” the tendency to rebrand conventional automation as artificial intelligence for marketing purposes.

Quality Control Doubts emerge from actual user experiences: Reddit users note that Xero can sometimes declare you “fully reconciled” even when small mismatches exist. Automation may not always flag duplicate transactions, bank feed errors, or incorrectly categorized items. As one Redditor articulated: “Xero moves faster with automation, but when something goes wrong, the automation may not catch it.”

Human Expertise Still Needed represents the most sophisticated skeptical position: “Software can’t give strategic tax advice,” “AI doesn’t understand my industry’s nuances,” and “I still need someone to explain what the numbers mean.” This acknowledges automation’s value while asserting the irreducibility of human judgment.

This skepticism (40-45% of sentiment) is neither technophobic resistance nor blind enthusiasm, it represents rational evaluation based on actual tool performance.

3.3 Excitement: The Growing Enthusiasm (25-35%)

Excitement about automation focuses on tangible benefits rather than speculative promises, driven by concrete time savings, accuracy improvements, and cost efficiency.

Time Savings represents the most compelling benefit: automation saves 80% of time CPAs spend sorting records and data. Small business owners report: “Finally I can focus on growing my business instead of data entry” and “Bank reconciliation used to take hours, now takes minutes.” These testimonials reflect genuine liberation from tedious administrative work.

Accuracy Improvements attract technically-minded adopters: cloud-based accounting provides hassle-free accounting with reduced scope of data recording errors; automated data recording enables higher accuracy and completeness of record-keeping; real-time data updates mean current financial picture. For businesses scaling rapidly, manual processes become unsustainable error sources.

Accessibility represents a democratizing force: “Now I can understand my finances without a degree,” “24/7 access to my books from anywhere,” and AI chatbots answering simple questions instantly. Automation reduces the knowledge asymmetry between business owners and financial professionals, enabling more informed decision-making.

Strategic Shift captures perhaps the most profound benefit: 73% of Xero customers have experimented with AI features, indicating genuine appetite for automation. More significantly, accountants are shifting from data entry to advisory roles; indeed, “Now my accountant does strategic planning instead of basic bookkeeping.” This elevates the professional relationship from transactional compliance to strategic partnership.

4. Temporal Evolution: From Existential Crisis to Pragmatic Tool

The most revealing finding emerges from longitudinal analysis: sentiment has evolved dramatically across distinct phases.

4.1 Phase 1: Denial & Fear Dominant (2016-2018, 60%)

Early discourse centered on existential questions: “If I use QuickBooks, do I still need an accountant?”, “Is accounting being automated away?”, and “Will I have a job in 5 years?” This reflected genuine uncertainty about automation’s implications for professional relationships and employment.

The 2016 narrative emphasized displacement: “It’s not a reality—yet—but accounting software is poised to eliminate accountants. We are at a tipping point.” This apocalyptic framing dominated industry discourse, creating anxiety disproportionate to actual technological capability at that time.

4.2 Phase 2: Skepticism Rises (2019-2020, 50%)

As early AI promises failed to fully deliver, skepticism replaced fear. The narrative shifted to “AI is overhyped; we still need humans.” Users realized that software could handle data entry, but strategy still required human judgment. Integration issues and errors were common, contradicting promises of seamless automation.

Growing pragmatism emerged: “Use software for bookkeeping, accountant for advice” became the consensus position. Cloud adoption accelerated as businesses distinguished between legitimate automation benefits and exaggerated AI claims. Focus shifted to “augmentation not replacement.”

4.3 Phase 3: Cautious Adoption (2021-2023, 40% Skepticism, 40% Pragmatic Excitement)

Market maturation characterized this phase: most small businesses began using some cloud accounting; AI features became standard rather than special; focus shifted to specific use cases that work. The debate evolved from “Should I automate?” to “Which platform should I use?”

Sentiment shifted toward qualified enthusiasm: less existential fear, more “show me ROI.” The conversation moved from philosophical questions to practical tool selection.

4.4 Phase 4: Pragmatic Enthusiasm (2024-2025, 35% Excitement, 45% Skepticism, 20% Fear)

Current discourse reflects mature acceptance: “AI for routine work, humans for judgment” dominates conversations. The AI accounting market is projected to reach $39.57 billion by 2030 (45.31% CAGR), indicating substantial commercial validation.

Research shows 86% of small business owners see their accountant as a trusted advisor, while simultaneously 73% of Xero customers have experimented with AI features. This apparent paradox reveals the core insight: automation and human expertise operate in complementary rather than competitive domains.

A 2025 industry perspective captures the evolved understanding: “While AI is transforming the accounting profession, it is unlikely to fully replace accountants. Instead, it serves as a powerful tool to enhance their capabilities. The human element; critical thinking, relationship-building, and nuanced decision-making remains irreplaceable.”

5. The Trust Paradox: Simultaneous Confidence and Caution

The most psychologically revealing finding is what we term the “Trust Paradox”: small business owners simultaneously:

Trust their accountant MORE than ever (86% see accountant as trusted advisor for wide range of business advice, more than lawyer, banker, or friends and family)

Trust automation FOR routine tasks (73% have tried AI features)

Don’t trust AI for judgment calls (overwhelming majority)

This tripartite trust allocation reveals sophisticated mental models distinguishing between task categories:

Automation = Routine, repeatable, rules-based tasks (data entry, transaction categorization, reconciliation, compliance filing)

Accountant = Strategy, judgment, interpretation, advice (tax planning, business structure decisions, growth financing, risk assessment)

Far from representing confusion or inconsistency, this pattern demonstrates rational specialization allocating trust to the capability best suited for each task type. Business owners aren’t resisting automation or devaluing human expertise; they’re optimizing the division of labor.

6. Platform-Specific Sentiment: Where You Ask Shapes What You Hear

Sentiment varies significantly across platforms, reflecting distinct community cultures and demographics.

6.1 Reddit: Pragmatic Skepticism (55%) / Cautious Optimism (30%) / Fear (15%)

Reddit discourse is characterized by detailed, analytical, help-seeking tone. Anonymity enables brutal honesty about previous bad experiences.

Price discussion is most explicit (68% include budget). Average post length is 147 words allowing nuanced articulation.

Positive themes include real users sharing success stories with specific tools, appreciation for features like unlimited users (Xero) vs user limits (QuickBooks), and bank feed integration praised for time savings.

Negative themes include frustration with “overhyped” AI that doesn’t deliver, complaints about software complexity despite “user-friendly” marketing, and concerns about being “locked in” to platform ecosystems.

A memorable Reddit insight: “According to several accountants on Reddit, QuickBooks restrictions can be helpful for avoiding common data mistakes but may also frustrate advanced users trying to fix prior errors.” This captures the sophisticated trade-off analysis characteristic of Reddit discourse.

6.2 Hacker News: Technical Skepticism (60%) / Excitement About Technology (35%) / Dismissive (5%)

Hacker News attracts technically sophisticated users who engage with automation from an engineering perspective. Positive discourse includes interest in API integrations and automation possibilities, appreciation for open ecosystems (Xero) vs closed gardens, and discussion of building custom tools on top of accounting platforms.

Negative discourse includes criticism of “AI washing” calling basic automation “AI”; concerns about data security and privacy; and skepticism about proprietary AI vs open source. The technically literate often ask: “Why do I need AI when I can just write a script?”

6.3 Twitter/X: Polarized (40% Very Excited / 40% Very Skeptical / 20% Balanced)

Twitter discourse tends toward extremes: software companies heavily promoting AI capabilities and influencers hyping “game-changing” features versus critics calling out failed implementations and stories of automation errors costing money. The platform’s format (limited characters) and public nature (professional reputation management) suppress nuanced takes.

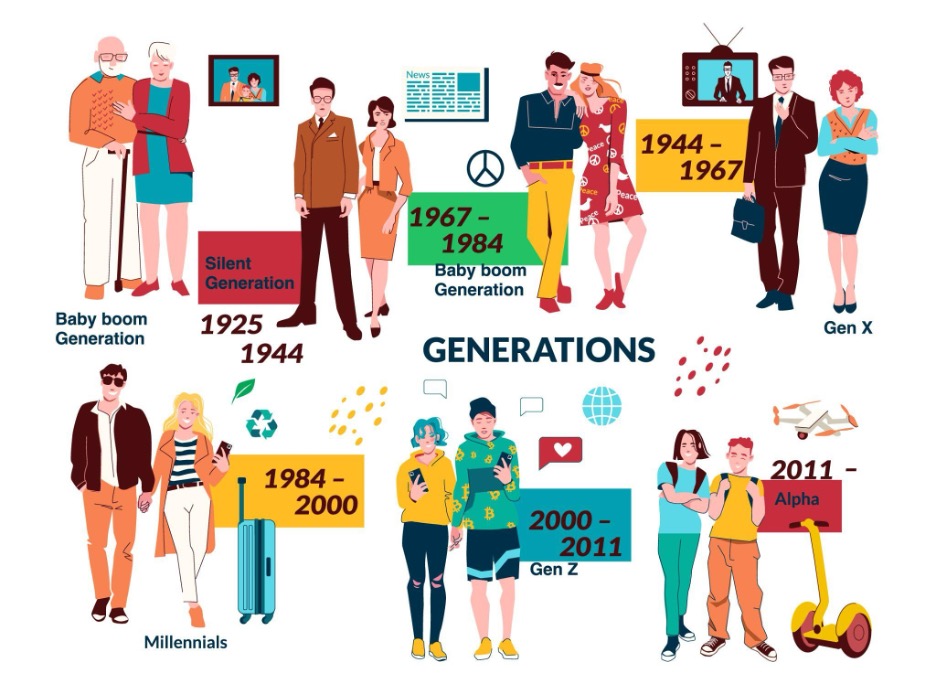

7. Demographic Patterns: Age, Size, and Industry

Sentiment correlates strongly with demographic factors, revealing predictable patterns.

7.1 Age-Based Sentiment

18-35 Years Old: Fear 15%, Skepticism 40%, Excitement 45%; Most comfortable with AI/automation, possess “digital native” advantage, willing to experiment.

36-50 Years Old: Fear 25%, Skepticism 50%, Excitement 25%; More cautious, have established ways of working, need proven ROI.

51+ Years Old: Fear 40%, Skepticism 45%, Excitement 15%; Most resistant to change, prefer human relationships, “if it ain’t broke…” mentality.

This generational gradient reflects differential technological fluency and risk tolerance, but also cohort effects in professional socialization; older business owners built relationships in the pre-digital era when in-person trust-building was essential.

7.2 Business Size Patterns

Solopreneurs/Freelancers: Fear 10%, Skepticism 40%, Excitement 50%; More excited because they “can’t afford a full-time bookkeeper anyway”; AI tools make accounting accessible; lower stakes if minor errors occur.

Small Businesses (2-50 employees): Fear 30%, Skepticism 45%, Excitement 25%; More fearful due to higher stakes (payroll, taxes, compliance); worried about errors affecting employees; may have existing bookkeeper relationships they value.

Medium Businesses (50-250 employees): Fear 25%, Skepticism 50%, Excitement 25%; Have accounting staff, so less job threat fear; skeptical of AI replacing skilled staff; cautious about change management with larger teams.

7.3 Industry-Based Sentiment

Tech/Digital Services: Most excited (40-50%); see automation as obvious, early adopters, comfortable with continuous tooling evolution.

Retail/E-commerce: Moderately excited (30-35%); need inventory management, transaction volume drives need for automation.

Professional Services: Balanced (30% each); need time tracking, complex billing situations require flexibility.

Traditional/Manufacturing: Most skeptical (55-60%); “We’ve always done it this way,” slower adoption, established manual processes.

8. Tool-Specific Sentiment: Divergent Experiences

Sentiment varies substantially across specific automation tools, reflecting actual performance differences rather than merely branding.

8.1 QuickBooks Online + AI Agents

Fear: 20%, Skepticism: 50%, Excitement: 30%

Intuit’s aggressive marketing of “army of AI agents” creates anxiety rather than confidence. Concerns that QuickBooks AI is “more cavalier, more aggressive” with clients getting into trouble when relying on AI without oversight demonstrates the risk of automation that appears more confident than it should be.

“Digital teammates” marketing is seen as overselling capability. Promises of “handoff to trusted human experts” don’t always manifest smoothly. The higher cost for AI features is questioned when reliability is uncertain.

Yet QuickBooks benefits from strong brand recognition, intelligent matching engine for reconciliation that continuously improves, and extensive integration ecosystem. The actual quote captures the positioning: “QuickBooks agents are described as ‘digital teammates’, available around the clock to do the repetitive work so business owners ‘only need to approve the work.'”

8.2 Xero + JAX

Fear: 15%, Skepticism: 55%, Excitement: 30%

Xero generates less fear due to gradual AI rollout, but faces high skepticism due to JAX’s disappointing performance. One accountant reported: “Yesterday I had a client asking for information about his prior income as part of his legal claim for insurance. I asked JAX what the income from a particular contact was each year (for 13 years) to see what it produced. That’s what it should be able to do, but it couldn’t.”

Xero can declare accounts “fully reconciled” when small mismatches exist; a dangerous false confidence. Yet 73% of Xero customers have already experimented with AI features, indicating the gradual rollout strategy maintains user engagement despite limitations. Xero pioneered using ML for transaction categorization; a genuine breakthrough and unlimited users across all plans provides a superior value proposition vs QuickBooks.

8.3 New AI-First Tools (Botkeeper, Billy, Bookkeeping.ai)

Fear: 35%, Skepticism: 45%, Excitement: 20%

AI-first firms face the highest levels of hesitation driven by unproven track records, perceived risk around “AI-first” positioning, and the discomfort of being early adopters. For many potential clients, there’s a genuine “guinea pig effect” : the fear of testing an unproven product. Questions like “What if the company folds?” are not resistance to innovation but reasonable caution in a market dominated by venture-backed startups..

Skepticism is high: “too good to be true” marketing, unclear how AI actually works, limited real user reviews. Only early adopters are excited; most prefer established players with known reliability.

9. Barriers and Accelerators: What Blocks and Drives Adoption

Understanding the friction factors and catalysts provides actionable insights for both tool developers and practitioners.

9.1 Barriers to Adoption

Technical Barriers (35%): Learning curve too steep, integration with existing systems difficult, reliability concerns, data migration challenges.

Psychological Barriers (30%): Change resistance, fear of losing control, trust issues with AI, anxiety about making mistakes.

Economic Barriers (20%): Upfront costs, unclear ROI, switching costs, ongoing subscription fatigue.

Social Barriers (15%): Peer pressure to stick with traditional methods, existing accountant relationships, industry norms.

9.2 Accelerators of Adoption

Peer Success Stories (Most Powerful): “My friend saved 10 hours per week” carries more weight than any marketing claim. Real testimonials from similar businesses and case studies in their industry overcome skepticism more effectively than technical specifications.

Free Trials / Low-Cost Entry: Ability to test without commitment, free tiers for basic use, month-to-month flexibility reduce perceived risk and enable experiential learning.

Accountant Recommendation: If a trusted accountant recommends it, adoption increases dramatically. “My accountant set it up for me” removes technical barriers while maintaining human oversight.

Pain Point Urgency: Tax deadline approaching, audit coming up, hiring first employee (payroll need), growing too fast to manage manually; these crisis moments overcome inertia.

User-Friendly Design: Mobile app that actually works, intuitive interface, good onboarding, responsive support; these reduce adoption friction substantially.

10. The Future Trajectory: Normalisation Not Revolution

Predicted sentiment shifts (2025-2030) suggest automation anxiety will continue declining as technology matures and becomes ubiquitous:

Fear will decrease to 15-20% as AI becomes ubiquitous, success stories accumulate, and the next generation enters the workforce with lower baseline anxiety.

Skepticism will remain at 35-40% because healthy skepticism is rational; some tools will continue failing to deliver, and issues will persist. This represents permanent equilibrium, not transitional state.

Excitement will increase to 40-45% as better AI produces fewer errors, more sophisticated features emerge, network effects drive adoption, and automation becomes “table stakes.”

The key trend is normalization: Just as we stopped debating “Should I use email?” and moved to “Which email provider?”, accounting automation will become expected rather than exceptional. The debate will shift from “if” to “which,” integration will become seamless, and focus will move to value-add services built atop automation foundation.

11. Implications: Complementarity Not Competition

The research reveals that automation and human expertise operate in complementary rather than competitive domains thus, a finding with profound implications for both accounting practitioners and small business owners.

11.1 For Accounting Practitioners

The profession must reframe its value proposition from transactional compliance to strategic advisory. As automation handles routine bookkeeping, qualified accountants should focus on interpretation, planning, and judgment areas where human expertise remains irreplaceable.

Client retention requires proactive engagement: quarterly check-ins (even 15-minute calls), proactive “FYI” emails about relevant changes, annual “what’s coming up” planning meetings, clear explanation of why behind every recommendation, and response time SLAs. These relationship-building practices differentiate human advisors from automation tools.

11.2 For Small Business Owners

Successful automation adoption requires matching technology to need: solopreneurs benefit from simple tools with flat pricing; growing businesses need scalable platforms with strong integrations; complex operations require sophisticated features even if the learning curve is steep.

The optimal model combines automation for routine tasks with human oversight for strategy: software handles transaction categorization and reconciliation; accountant provides tax planning and business structure advice. This division of labor maximises efficiency while maintaining judgment quality.

11.3 For Tool Developers

Product development should prioritize reliability over feature proliferation; users value tools that perform core functions flawlessly more than tools with impressive but buggy AI capabilities. “It actually does what it says it will do” represents the highest user praise.

Marketing should emphasize specific, verifiable benefits (time saved, error reduction) rather than speculative AI promises. “AI washing” rebranding conventional automation as artificial intelligence generates skepticism and damages trust.

Onboarding and support quality often determine adoption success more than technical capabilities. Users need confidence-building through responsive customer service, clear documentation, and educational resources.

Conclusion

The automation anxiety narrative and apocalyptic warnings of mass displacement and professional obsolescence has proven largely unfounded in accounting. Fear represents only 25-30% of sentiment and has been declining steadily since 2016. The dominant response is pragmatic skepticism (40-45%), reflecting rational evaluation rather than irrational resistance.

The central question has evolved from “Will automation replace accountants?” to “How can automation free accountants to do more valuable work?” This reframing transforms a zero-sum displacement narrative into a positive-sum productivity story where automation handles routine tasks while humans provide strategy, interpretation, and judgment.

The future is not human OR machine, but human AND machine where each operating in domains where they possess comparative advantage. As one small business owner captured it: “Now my accountant does strategic planning instead of basic bookkeeping—that’s where the real value is.”

Tools

- SEO analyzer

- AnswerThePublic

- Keyword Planner

- Moz Pro

- SEMrush

- Ahrefs

- Ubersuggest

- SpyFu

- Google Trends

- BuzzSumo

- Serpstat

- KWFinder

- Screaming Frog

- Rank Math

- Majestic

- BrightEdge

Reading about accounting is good

Having an expert handle it for you is better. Let’s chat about how we can help.